China’s New Birth Subsidy Policy: Economic and Demographic Outlook

by China Decoded

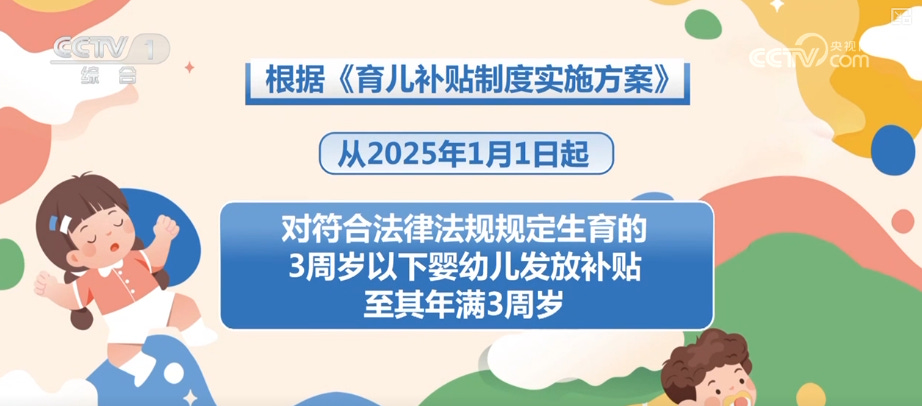

Starting January 1, 2025, China has introduced a nationwide, unified child subsidy program aimed at families with children aged below three. Eligible families receive an annual cash subsidy of RMB 3,600 per child, payable for up to three years, for a total maximum of RMB 10,800. The subsidy is exem…