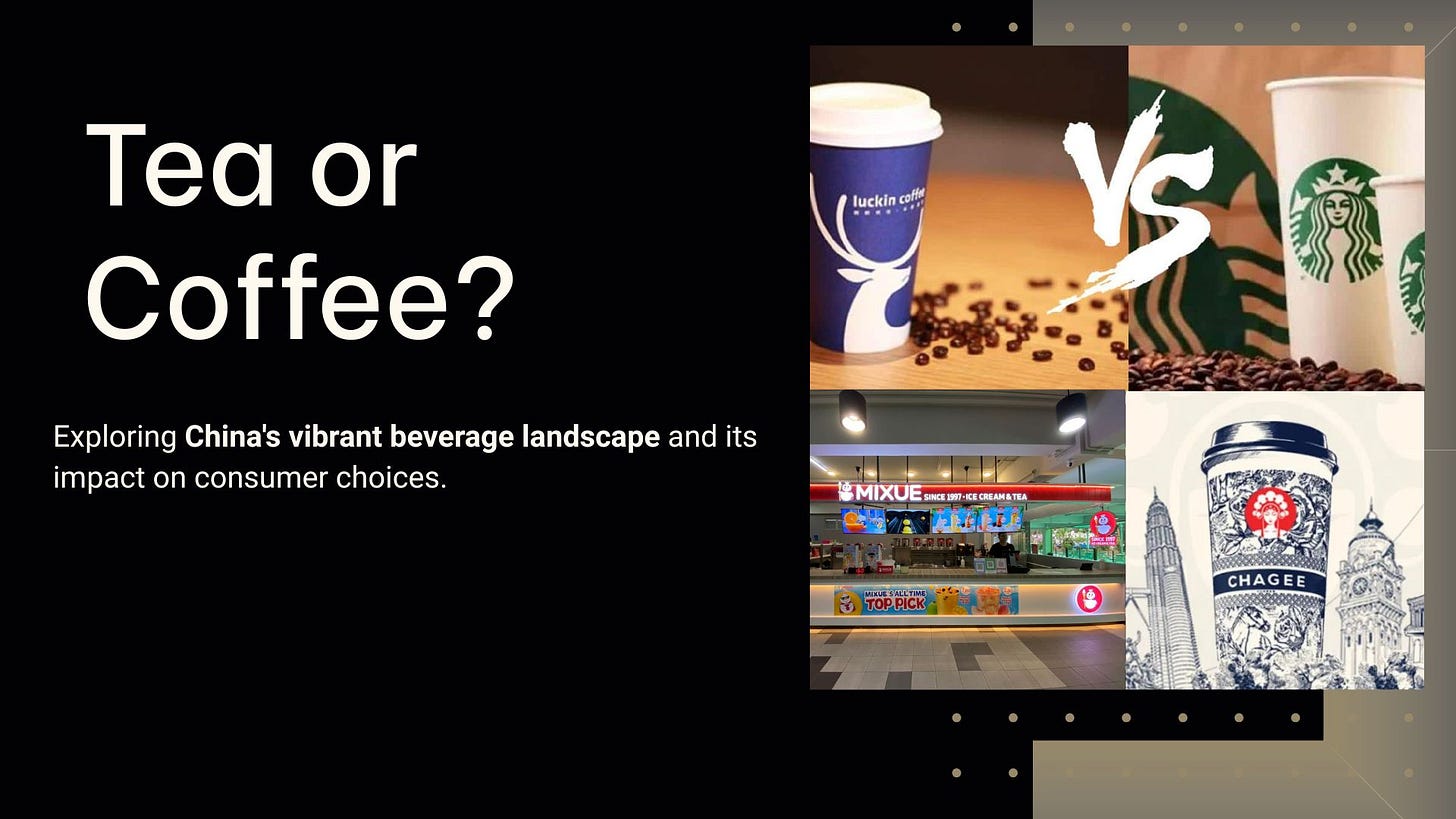

Tea or Coffee?

China’s Beverage Battle Creates a New Consumer Landscape

Introduction

China’s beverage scene is undergoing a dramatic transformation. The spectacular rise of new-style tea (led by the likes of Mixue Bingcheng and Heytea) and the relentless expansion of coffee chains (such as Luckin and Manner) reflect deeper shifts in tastes, culture, and consumer values. Are tea and coffee rivals, or partners in building a dy…